Blog Content Overview

Overview

What are ECB?

External Commercial Borrowings (“ECB”) are commercial loans raised by eligible resident entities from recognized non- resident entities and should conform to parameters such as minimum maturity, permitted and non permitted end-uses, maximum all-in-cost ceiling, etc. Transactions on account of ECBs are governed by the provisions of Foreign Exchange Management Act, 1999 and the Master Direction – External Commercial Borrowings, Trade Credits and Structured Obligations (2018-19) issued by the RBI and as amended from time to time (“ECB Master Directions”)

External Commercial Borrowings (“ECB”) are commercial loans raised by eligible resident entities from recognized non- resident entities and should conform to parameters such as minimum maturity, permitted and non permitted end-uses, maximum all-in-cost ceiling, etc. Transactions on account of ECBs are governed by the provisions of Foreign Exchange Management Act, 1999 and the Master Direction – External Commercial Borrowings, Trade Credits and Structured Obligations (2018-19) issued by the RBI and as amended from time to time (“ECB Master Directions”)

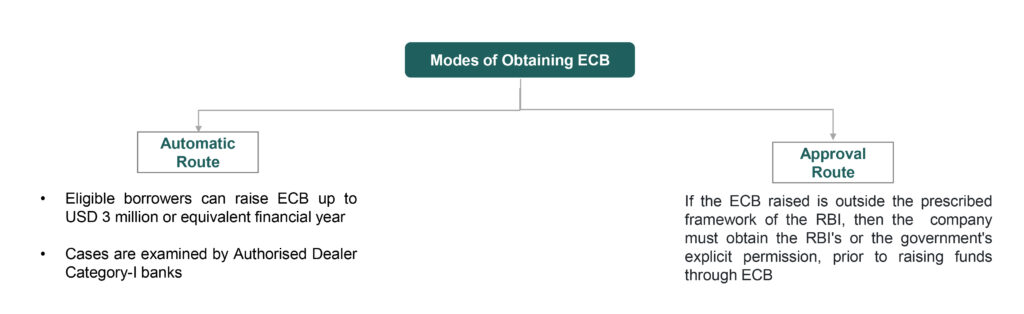

RBI permitted Startups to raise ECB with the introduction of new guidelines vide its circular dated 16th January, 2019. Pursuant to the said guidelines, AD Category-I Banks are permitted to allow recognized Startups to raise ECB under the automatic route as per the prescribed framework

Recognized Lenders

•Lender/Investor, who is a resident of a Financial Action Task Force compliant country

•The recognized lenders do not include the following:

- Indian banks’ foreign branches or their Indian subsidiaries; and

- Overseas entity in which Indian entity has made overseas direct investment

Key Considerations

| Term | Brief description |

| MAMP* | MAMP for ECB will be 3 years. |

| Forms | The borrowing can be in form of loans or non-convertible, optionally convertible or partially convertible preference shares |

| Currency | The borrowing should be denominated in any freely convertible currency or in Indian Rupees (INR) or a combination thereof |

| Amount | The borrowing per Startup will be limited to USD 3 million or equivalent per financial year (either in INR or any convertible foreign currency or a combination of both) |

| All-in-cost | As may be mutually agreed between the lender and borrower |

| End-uses | For any expenditure in connection with the business of the borrower |

| Choice of Security | At the discretion of the borrower. Security can be in the nature of: -movable assets; -Immovable assets; -intangible assets (including patents, intellectual property rights); -financial securities and shall comply with foreign direct investment or foreign portfolio investment/ or any other norms applicable to foreign lenders -Issuance of corporate and personal guarantee. Guarantee is only allowed if such parties qualify as lender under ECB for start-ups |

| Conversion Rate | In case of borrowing in INR, the foreign currency – INR conversion will be at the market rate as on the date of agreement |

Notes : * MAMP: Minimum Average Maturity Period * All-in-cost: It includes rate of interest, other fees, expenses, charges, guarantee fees, Export Credit Agency charges, whether paid in foreign currency or INR but will not include commitment fees and withholding tax payable in INR.

Other Provisions

| Term | Brief description |

| Parking of ECB Proceeds | ECB Proceeds can be parked abroad as well as domestically •If ECB Proceeds parked/repatriated to India, ECB borrowers are allowed to park ECB proceeds for a maximum period of 12 months cumulatively |

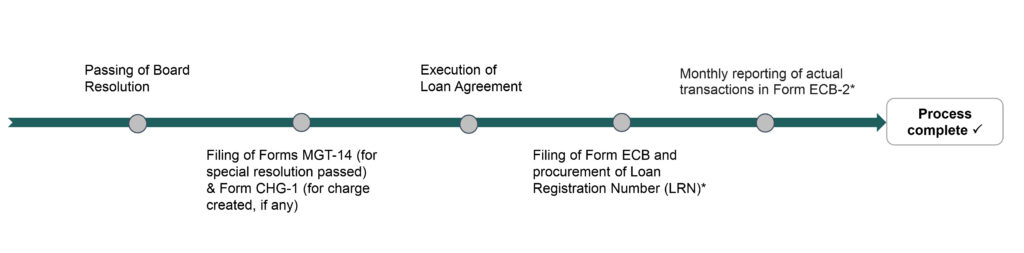

| Reporting arrangements | Submission of Form ECB and obtaining loan registration number (LRN) •Any change in terms and conditions of ECB should be reported to DSIM through revised form ECB •Monthly reporting through form ECB 2 |

| Conversion of ECB into Equity | • Conversion is allowed subject to the conditions such as (without limitation): – activity should be covered under automatic route for FDI or government approval is received where required -conversion must not contravene eligibility or applicable sectoral cap on foreign equity holding -compliance with applicable pricing guidelines • The exchange rate prevailing on the date of the agreement between the parties concerned for such conversion or any lesser rate can be applied with a mutual agreement with the ECB lender •Equity ratio of 7:1 not applicable |

| Non applicability of Equity-liability ratio | The requirement of equity liability ratio of 7:1 as prescribed under the ECB Master Directions is not applicable for start-ups |

Other provisions summarised in short

Process Flow

Notes :

LRN: Any drawdown in respect of an ECB should happen only after obtaining the LRN from the RBI. To obtain the LRN, borrowers are required to submit duly certified Form ECB, which also contains terms and conditions of the ECB, in duplicate to the bank

Monthly Reporting of Actual Transactions: Form ECB 2 Return through the AD Bank on monthly basis.

We Are Problem Solvers. And Take Accountability.

Related Posts

Informatory Note on Appointment of Company secretary

DOWNLOAD FULL PDF Swipe to view more detailed information on:…

Learn More

Circular Resolution – Understanding Meaning, Process Structure

DOWNLOAD FULL PDF Circular resolutions, as per Section 175 of…

Learn More

Understanding Meetings as per the Companies Act, 2013

DOWNLOAD FULL PDF Our latest document provides comprehensive insights into…

Learn More